Smart contracts come with a plethora of benefits. They are tamper-resistant, self-executing, and self-verifying. They are also changing the face of the banking industry in the form of error-free processing of insurance claims, smooth peer-to-peer transactions, streamlined KYC processes, transparent auditing, and so on. In this article, we will discuss the positive changes that smart contracts have brought into this industry.

Simply put, smart contracts are self-executing programmable contracts that encode an agreement between two or more parties. The terms of a transaction are written as a protocol that exists across a distributed, decentralized blockchain network system.

Unlike traditional contracts, they do not involve any paperwork or third-party validation. The contract is computer-coded, and compliance is ensured using the blockchain technology. Smart contracts validate autonomously upon completion of the contract terms.

These have the potential to automate manual banking processes. It is useful for functions like compliance, claims-processing, and evaluating loan eligibility.

The functioning of smart contracts

Smart contracts are computer-coded blockchain applications. They work on pre-programmed terms and conditions that govern a transaction between two organizations. The terms are executed on a condition-based principle. Both parties can interact and respond in real-time to “if-when-then” conditions of the contract. It allows parties to transact anonymously if needed.

The main features of smart contracts are:

- Compliance and controlling happen within the system without the involvement of any party. Smart contracts are self-executing. They are independent.

- They automatically source information from external data sources, which makes them self-verifying.

- Smart contracts are tamper-resistant and guarantee more security as intermediaries are not involved.

- They offer faster resolution than manual processes, which saves time for both parties.

- They remove trust issues from any contract because of the transparency they offer.

- Smart contracts eliminate the need for third-party mediation at the time of settlement.

- The execution of smart contracts is free of cost.

- They securely handle sensitive data, and all associated data remains in the blockchain platform for future use.

- A cryptographic digital signature verifies participation in the contract, making them an ideal choice for high-end contracts.

Smart contract typologies

Now that you have a basic understanding of what these are and the benefits they are, let us explore the different types of smart contracts in IoT systems:

1. Smart legal contracts

These contracts can simplify legal processes and ensure strict adherence to regulatory guidelines. They are applicable for critical financial, international trade, and real estate market contracts. The current legal framework lacks sufficient context and support for automated contracts on the Blockchain. However, once the laws are in place, it will be easier to use them.

2. Decentralized autonomous organizations (DAOs)

These are contracts built for blockchain communities. The participants of these communities abide by the set of rules put into the contract’s code. Crowdfunding platforms, for instance, use DAOs. Many smart contracts make up rules, and they work towards effectively policing and supervising participants. This ensures enhanced support amongst all parties.

3. Application logic contracts (ALCs)

If you have ever heard of the Internet of Things (IoT) concerning the Blockchain, chances are you must have come across Application Logic Contracts or ALCs. These contracts are application-specific codes that work in conjunction with other programs on the Blockchain.

They help establish and validate communication between IoT devices. ALCs make up a vital piece of every multi-function smart contract and majorly function under a managing program.

Examples of Blockchain-based smart contracts

When the concept of smart contracts originated in 1994, little did anyone know that Blockchain technology would make the task of embedding those contracts into computer code that simple, ensuring transparency and security of all records.

It is a public Blockchain platform that allows developing smart contracts accessible through its ready-to-use templates. The smart contracts created using NXT cannot be customized, as it uses a scripting language that is not Turing-complete.

2. Ethereum

It is a Blockchain platform that supports building advanced and customized smart contracts. It uses a stack-based bytecode language which is a Turing-complete high-level programming language. The code of these contracts is executed in the Ethereum Virtual Machine (EVM).

3. Sila

It offers application program interfaces (APIs) for integrating real-world payment functions of banks such as KYC, ACH, and digital payments. To create a smart contract on Sila, simply put in the assets and request the code to execute automatically for delivering the assets.

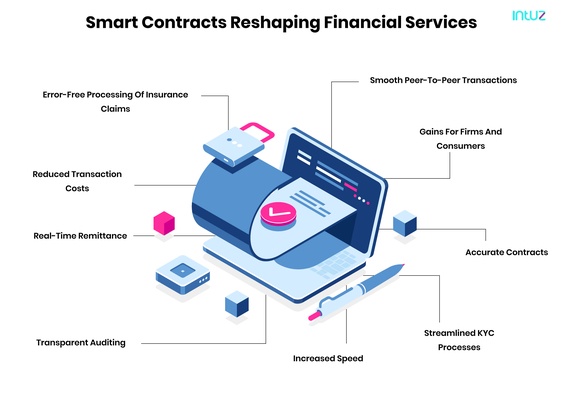

Smart contracts reshaping financial services

Smart contracts are very well on their way to changing how and the speed at which business gets done across sectors. The financial service industry is no exception either. Smart contracts can come in handy for the following processes in banks and financial institutions.

1. Error-free processing of insurance claims

Assessing the legitimacy of an insurance claim is a tedious process. Counter-checking the terms of a manual contract and validating the claim takes a long time. Blockchain-driven smart contracts offer automated insurance claim processing to the banking industry.

2. Reduced transaction costs

The transactions governed by smart contracts are self-regulatory. This facilitates low-cost record-keeping and reduces manual intervention, which considerably lowers transaction costs in the long run.

3. Real-time remittance

The adoption of digital modes of payments has raised the demand for a fool-proof remittance system. Blockchain-based smart contracts ease payment processing allowing real-time fund transfer while maintaining accuracy and transparency. They also speed up transaction settlements by allowing their autonomous verification.

4. Transparent auditing

Record-keeping is essential to facilitate audits. Traditional contracts involve a lot of paperwork, and banks have to invest resources to manage them. Blockchain-powered smart contracts support advanced bookkeeping tools.

These are based on incorruptible and distributed codes in the Blockchain network. The solutions enhance the transparency of records stored while eliminating any possibilities of infiltration.

5. Increased speed

Automating manual tasks through software codes helps reduce transaction times. It helps speed up banking operations by cutting down unnecessary manual processes.

6. Streamlined KYC processes

KYC is a crucial function in the financial services industry. Banks and FIs verify customer identity before offering a loan or engaging in other transactions with an individual. A smart contract system makes the process easier for banks.

They can verify credit scores of individuals and identities based on Blockchain records. Related compliance requirements like tax returns are also processed in real-time — a fantastic support for accounting firms.

7. Accurate contracts

Transactions driven by smart contracts are transparent and self-executable. They reduce the chances of error by eliminating human intervention. That is why they cultivate heightened trust amongst the parties involved in the contract.

8. Gains for firms and consumers

Both banking institutions and customers benefit from implementing smart contracts. Banks save costs and streamline processes to ensure regulatory compliance. Customers also gain from easier and safer transaction methods. Everyone wins!

9. Smooth peer-to-peer transactions

Banks are customer-centric, and when they are looking to implement a technology that helps them, they want to ensure it also works for their customers and clients.

Smart contracts use Distributed Ledger Technology (DLT) to eliminate third-party mediation. It leads to cost reduction and simplifies transactions for those without a bank account. The adoption of cryptocurrencies by retailers is facilitating peer-to-peer payments.

Smart contracts enable such transactions, including cross-border payments, without the involvement of any trusted third parties. They offer convenience and stability.

Opportunities for smart contracts in banks and financial institutions

Blockchains-powered smart contracts offer banks the ability to streamline trade clearing and settlement activities. Traditionally speaking, the process is labor-intensive and prone to errors due to the involvement of various parties for approvals and reconciliations.

Smart contracts help in avoiding discrepancies and saving costs by developing an efficient equity settlement system. Along with 40 global banks within the R3 consortium, Wall Street is currently testing smart contract-based clearing and settlement systems.

Similarly, the Australian Securities Exchange and the Depository Trust & Clearing Corporation (DTCC) are also working on a smart contracts-based post-trade platform.

2. Supply chain and trade finance documentation

Decentralized ledgers of Blockchains help streamline supply chain and trade finance documentation. They are more efficient than paper-based systems and significantly reduce processing time.

On the other hand, digitizing letters of credit and bills of lading is also not feasible as the chances of forgery are higher. Blockchain offers secure and easily accessible receipts of transactions.

Smart contracts ease documentation and workflow management through digital signatures. Barclays Corporate Bank, for instance, has recently partnered with a startup platform Wave. It uses Blockchain to store bill-of-lading documents. The platform uses smart contracts to automate log change of ownership and payment processes.

Seven banks, including Bank of America, Standard Chartered, and the Development Bank of Singapore, have also given proof-of-concept testing for their organizations.

3. Simplification of complicated processes

Organizations must review their internal processes and evaluate possibilities of simplifying complex ones using Blockchain. They can automate manual workflows and facilitate interdependent transactions using smart contracts. Corporations can also establish trust among parties for multiparty agreements by offering transparency.

4. Improved securities

The traditional settlement and clearance processes of securities markets are inefficient. Market participants have to deal with opaque systems while their money remains trapped for uncertain durations. Smart contracts can make processes transparent and reduce the settlement timeline to a few minutes or even seconds.

5. Lending with well-defined T&Cs

Legacy systems run on the revenue generated by the difference in rates of interest paid to their investors and that charged from their borrowers. A massive population of borrowers cannot meet the stringent lending criteria of traditional lending institutions.

Deploying a smart contract system helps monitor the loans of such borrowers. Using DLT, borrowers who do not qualify for a loan from a bank can borrow directly from investors, thus shortening the timescales within which one can procure loans.

BlockFi even facilitates lending against cryptocurrency collateral with well-defined terms for interest payments.

6. Improved KYC and fraud prevention

Banking processes across the globe have made customer identity verification, also known as KYC, mandatory. It is an essential step in all financial activities, including trading, borrowing, and lending.

However, obtaining customer credit histories under legacy systems is tedious and costly. But it is a necessary step to avoid financial fraud. A smart contract system can help banks streamline KYC operations.

They can easily verify customer identity through records maintained on the Blockchain and trace down an individual’s credit history.

7. Minimized entry barriers for SMBs

Banks that run on legacy systems usually have cumbersome onboarding processes. Lengthy documentation and multi-step verification reduce accessibility for SMBs. Smart contracts lower the entry barriers for SMEs and startups.

DeFi, for instance, offers blockchain solutions that accelerate the adoption of traditional banking systems. It helps build processes to match the agility of small businesses. Financial institutions can select appropriate offerings to fill market gaps.

They can reshape traditional financial models and roll out new instruments by leveraging the capabilities of decentralized ledgers. No wonder there is an increase in demand for IoT development services from small and medium-size businesses.

8. Versatile tokenization

Blockchain has established an identity as a platform to deliver stable and secure processes. Tokenization helps financial institutions avoid risks associated with cryptocurrencies and the market volatility that drives them.

They are now offering variations of tokens, such as Stablecoins, which are transactional fractions of major currencies. Their linking to Dollars or Euros ensures risk coverage and stability against market fluctuations.

9. Efficient online donations

Online donations have considerably advanced the way charities collect donations making it easy for supporters to select causes.

Through smart contracts, charities can make impact-based donations that include clauses stipulating that the money gets transferred only if specific trigger conditions are met.

Such contracts will increase the trust of supporters and enhance overall transparency and openness in the process. Plus, smart contracts reduce unnecessary (and sometimes high) donation processing and transactional costs.

How Blockchain can disrupt banking

Blockchain can disrupt traditional banking models. Banks adopting smart contracts will minimize their operational costs and risks significantly while limiting chances of errors.

The transparency offered by banks will help them nurture long-lasting customer relationships by providing satisfactory services consistently.

Smart contracts backed by blockchain technology can empower retail banking business models. There are some challenges to broader adoption of the technology by banks like scalability, volatility of cryptocurrencies, and developing stakeholder trust.

But, by deploying the right regulations and rules, safer banking systems can be established, and customer engagement can be boosted.

In conclusion

Without a doubt, smart contracts can unlock valuable insights for banks and financial institutions and carry out their operations more smoothly and efficiently. Technology leaders envision many apps for Blockchain-based smart contracts.